Explore our library, where insights, press articles, and events are organized by tags, making it easy to find relevant topics.

white paper February 2025 HindSIGHT report No 1

Over the past 25 years, the fashion and luxury industry has created significant value, reflected in the massive personal wealth amassed by its super-winners. Using Forbes data as a proxy, the industry now ranks as the third-largest wealth creator, behind technology and finance. Yet, much like the rapidly evolving fashion landscape, the list of billionaires and their net worth is also undergoing a dynamic redistribution. Examining the patterns of wealth creation within the fashion and luxury industry offers inSIGHTS not only into this industry’s evolution over time and its current state, but also into where it may be headed next.

(Released on February 28, 2025)

press December 2024 Getting dressed will be fun again

Financial Times by Kati ChitrakornAchim shares his perspective on the key themes shaping the fashion industry in 2025.

After a drop in global sales of personal luxury goods in 2024, the industry is hopeful for modest recovery in 2025. Achim highlights the need to correct overinflated pricing and notes that structural changes, including the offloading of underperforming assets, may be necessary. Ethical and social responsibility will remain critical and growth opportunities will be mostly seen in emerging markets. Major deals in the fashion industry are unlikely in the near term due to stagnant IPO markets. Nevertheless, Achim predicts further consolidation across the industry in the months ahead as well as a shift back to a more personal, individualistic style.

press December 2024 Will luxury stocks remain slow sellers?

Der Aktionär Edition 2025 by Sarina RosenbuschIn an interview with Der Aktionär, Achim provides his perspective on the outlook for the fashion and luxury market in 2025. Next year will remain challenging for luxury brands, marked by ongoing market consolidation. While the luxury categories of fashion, jewelry, and watches face significant headwinds, demand for experiences and travel continues to thrive. Additionally, more space has emerged between the mid-market and luxury segments, allowing premium brandslike Coach to flourish. Fast fashion players such as H&M and Zara are elevating their positioning to differentiate themselves from Asian competitor Shein, while appealing to customers who increasingly prioritize value for money and sustainability. Meanwhile, the booming sportswear segment is undergoing dynamic shifts, with challenger brands (e.g., On, Lululemon, Skechers) steadily gaining market share from the incumbents Nike, Adidas, or Puma.

linkedin February 2025 Is luxury elder care the next frontier?

Is #luxury #elder #care the next frontier? This weekend, I came across an intriguing Financial Times article about the rise of high-end care homes in the…

press December 2024 Fashion industry faces cautious consumers during Christmas s...

tagesschau24 Update Wirtschaft by Anne-Catherine BeckAchim discusses on German television how this year’s Christmas business is unfolding for the fashion and luxury industry.

He points out that while city centers may seem less busy, people are still shopping, especially now during the holiday season – but there is a noticeable reluctance to spend. Affordable luxury in particular is struggling as aspirational consumers cut back, while high net worth individuals continue to spend at the top end of the segment. There are fewer tourists from SoutheastAsia as they shift their spending to Japan given favorable exchange rates; although Americans and Middle Eastern customers are increasingly present inEurope. In addition, online and secondhand sales are growing and taking sharefrom brick-and-mortar stores. Achim attributes the industry’s challenges to a stagnant market in Europe, economic uncertainty, and an increasinglycompetitive landscape. This has led to a wave of consolidation, as evidenced by the recent acquisitions such as the Zalando-About You or MyTheresa-Net-a-Porterdeals.linkedin How to Spend It...

has been one of my favorite weekend rituals for over 20 years. There’s something special about getting up early on a Saturday, when thelinkedin February 2025 Is luxury elder care the next frontier?

Is #luxury #elder #care the next frontier? This weekend, I came across an intriguing Financial Times article about the rise of high-end care homes in the…

press December 2024 Luxury and Fast Fashions Are Creating Billionaires Galore

WWD by Miles SochaAchim talks to WWD about our research on the fashion and luxury industry’s wealth creation.

Fashion and luxury billionaires, led by LVMH’s Bernard Arnault and Inditex’s Amancio Ortega, have solidified their wealth despite global crises and a pandemic, with fashion and luxury ranking as the third-largest wealth-creatingindustry after technology and finance. The analysis highlights the polarizationin the industry, where luxury and value players dominate, while the mid-market struggles. It also showcases a dominance of European-based billionaires that account for 81% of the sector’s net worth. Looking forward, business model innovations, such as Inditex’s agility and Shein’s direct-to-consumer approach,coupled with the growing middle-class worldwide, suggest a resilient and prosperous future for fashion and luxury.

press November 2024 Why German car manufacturers are failing with their luxury s...

WirtschaftsWoche by Nele Antonia HöflerAchim lends his expertise on luxury strategy to examine the German auto industry's challenges.

In their ambition to establish themselves as luxury brands, German carmakers such as Mercedes, BMW and Audi are encountering obstacles. Despite efforts to appeal to high-end consumers, they are struggling to differentiate from the mass market and establish a true sense of exclusivity.

linkedin Interview #1 - Vanessa Friedman; Fashion Director & Chief Fa...

Why Luxury Goods Companies Should Take Back Their Products and the Addiction to Consumption These were just a few of the topics I discussed recently with Vanessa Friedman Fashion Director and Chief Fashion Critic at The New York Times. Vanessa and I first met 15 years ago when she was the inaugural Fashion Editor at The Financial Times. It was then that we began the partnership between McKinsey & Company and the FT’s Business of Luxury Summit Series. I fondly remember events like the one in Marrakech, where I had the privilege of moderating a panel with Moncler‘s Remo Ruffini.

press October 2024 He Transformed the Red Carpet. Now What?

The New York Times by Vanessa FriedmanAchim comments on the challenges of relaunching heritage brands, particularly the high financial and time investment and the corporate structures required. Daniel Roseberry has transformed Schiaparelli into a celebrity favorite with bold designs that spark public debate. Despite limited retail presence and no mass marketing, high-profile clients like Kim Kardashian and Lady Gaga have kept the brand relevant in fashion's attention economy. Now, as Schiaparelli expands into ready-to-wear and accessories, Roseberry faces the challenge of making the brand commercially viable while maintaining its exclusivity, marking thebeginning of a crucial "Act II."

press October 2024 With New Fragrances, Bottega Veneta Smells a Hit

Wall Street Journal by Rory SatranAchim shares his perspective on why luxury brands are increasingly venturing into the beauty segment.

Bottega Veneta is launching a collection of five unisex luxury fragrances this October. These high-end perfumes are the first project to be launched by the newly formed Kering Beauté, the conglomerate's division dedicated to the booming beauty industry. According to Achim, beauty is an attractive segment for luxury brands as it has proven to be more resilient than fashion.

press October 2024 Luxury online retail – Mytheresa is now facing these challen...

WirtschaftsWoche by Nele Antonia HöflerIn an article in WirtschaftsWoche, Achim comments on the challenges that online luxury retailers like MyTheresa are currently facing and how they can overcome them.

MyTheresa has announced plans to acquire rival Yoox Net-a-Porter in a bid to become the leader in online luxury e-tailing. However, the company faces several challenges as demand for luxury goods has weakened due to uncertain consumer sentiment and rising prices of luxury goods. In addition, luxury brands are increasingly turning to direct sales and moving away from multi-brandplatforms. Growth alone is no longer sufficient for luxury online players; instead investors are now demanding profitability. MyTheresa plans to overcome these hurdles through synergies, a curated offering and the integration of YNAP's platform and customer data.

press October 2024 Giorgio Armani- L’uomo, il marchio, l’azienda

Book by Frank Pagano and Marco DiDio RoccazzellaAchim pays tribute to Giorgio Armani in the afterword of the book "Giorgio Armani - L'uomo, ilmarchio, l'azienda" by Frank Pagano and Marco Di Dio Roccazzella, published by Il Sole 24 Ore in October 2024.

Achim honors Armani’s keen ability to consistently deliver distinctiveness and timelessness—kept at the core of everything he did—over five decades in business. Armani parlayed his signature aesthetic and his distinctive vision for lifestyle into a thriving brand, growing it into a multi-billion, multi-gender, multi-category global fashion group. All while maintaining the company's independence and full ownership in an industry that is characterized by intense consolidation.

press October 2024 What's next for luxury e-commerce

glossy.com by Jill ManoffAchim discusses his perspective on the future of luxury e-commerce with Glossy's Jill Manoff.

Luxury brands are increasingly by passing multi-brand e-tailers, offering direct-to-consumer sales with full product ranges, exclusive perks, and enhanced omnichannel experiences. Many once highly valued e-commerce platform shave struggled to achieve profitable growth in a high-interest rate environment, while others, such as Mytheresa, have thrived by focusing their differentiation strategy on curation rather than low prices, and by building customer loyalty through exclusive services and events. Although luxurye-commerce is projected to grow by 20 to 30 percent, physical retail will remain essential for luxury brands.

event September 2025 Chalhoub Group in:sight summit

Back in Dubai for the Chalhoub Group’s in:sight summit, Achim had the pleasure of discussing the future of luxury in the GCC. The region’s economy is experiencing steady growth, fueled by robust GDP, low inflation, and rising consumer confidence. Furthermore, non-oil sectors are building momentum and the economic decoupling is gaining traction. The beauty sector continues to outperform, and while Dubai maintains its position as the region’s luxury hub, Saudi Arabia requires new models to unlock its full potential. Across the GCC, consumers are becoming true luxury connoisseurs who are globally minded and trend-savvy.

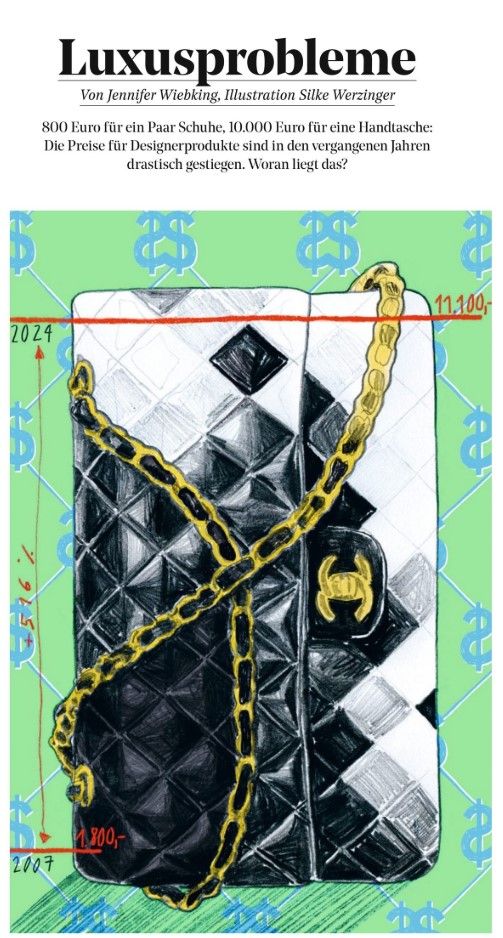

press September 2024 LuxuryProblems

FAZ Magazin by Jennifer WiebkingAchim talks with Jennifer Wiebking from the FAZ about the luxury goods boom, the COVID effect, and why the industry is now suffering a post pandemic hangover.

Luxury fashion prices have risen dramatically, with Chanel's iconic 11.12 bag increasing by 470% since 2007, reflecting broader hyperinflation across the industry. As a result of the massive price increases, more accessible luxury brands such as Longchamp and new entrants such as Polène are gaining popularity, offering high quality products at relatively lower prices amidst rising consumer price sensitivity.

linkedin The 2025 Forbes Billionaires List is out - and it’s clear: F...

The combined net worth of fashion and luxury billionaires in the Forbes Top 200 fell to $522bn, down 16% from $617bn in 2024. That decline is mirrored in the number of fashion/luxury figures in the Top 200: just 10 in 2025, compared to 14 last year. Notable drop-offs include: • Giorgio Armani now ranked #208 with $11.8bn • Sky Xu (Shein Shein) now #323, net worth down by $2bn • Michael Rubin (Fanatics slipped to #248 • Nicolas Puech (Hermès heir, 5% stake): dropped entirely Last year, Bernard Arnault (LVMH) briefly claimed the top spot as the world’s richest. But tech is back on top: Elon Musk has reclaimed #1 with a net worth of $342bn (as of March), while Arnault fell to #5, with his fortune down to $178bn (from $233bn). ...

event February 2026 FashionSIGHTS Salon - What is the future of German luxury?

Our first FashionSIGHTS Salon is dedicated to the question: What is the future of German luxury?

At the heart of the evening are three questions currently shaping our industry: whether Germany has a culturally complex relationship with the concept of luxury; why the country boasts a strong luxury retail landscape yet has, to date, produced no internationally significant luxury maisons; and how the German luxury market may evolve in the years ahead.

press February 2025 Major luxury groups show weaknesses - with exceptions

WirtschaftsWoche by Emma MöllenbrockAchim discusses the broader challenges of struggling luxury houses and success factors that set certain brands apart from its competitors.

The luxury sector is facing challenges as consumer demand weakens and growth driven by price increases reached its limits. Achim highlights two successful categories: zeitgeist brands that thrive on trends, and exclusive high-end brands like Hermes, benefiting from wealthy buyers whose spending remains stable during economic downturns. In contrast, luxury brands focusing on volume rather than exclusivity, such as Gucci and LVMH, are more vulnerable to economic fluctuations. Achim emphasizes that profitability and an adapted pricing strategy will be key to sustaining growth in the future.

linkedin July 2025 Interview #33 - Lauren Sherman, Fashion Correspondent, PUCK

Why luxury is like toothpaste: squeezed out and consumed, often without much thought. My latest interview with Lauren, fashion correspondent at Puck and host of the podcast #Fashion #People, was a real standout. Lauren brings sharp insight and unfiltered commentary to the world of fashion and luxury. In our conversation, we unpacked how luxury became mainstream, the unexpected role of digital music, the pandemic’s accelerant effect - and why luxury now finds itself in a moment of crisis. It was pointed, thought-provoking, and thoroughly entertaining: just like her podcast, which I highly recommend. Lauren and I first connected years ago when she was with The Business of Fashion and I was co-editing the State of Fashion report. Reconnecting and diving into the fashion landscape - candidly and without hesitation - was a real pleasure. This conversation is part of my ongoing interview series for my upcoming book on the Future of Fashion.

linkedin Interview #34 - Sima Ved, Founder & Chairwoman, Apparel Grou...

Why #Dubai Is Emerging as the New #Gateway for #Fashion in the GCC and Beyond That was at the heart of my conversation with Sima Ganwani Ved, Founder and Chairwoman of Apparel Group, during my recent visit to Dubai. We spoke about the region’s remarkable economic resilience, its smart and decisive handling of the pandemic, and the bold ambitions shaping both Dubai’s growth and Saudi Arabia’s Vision 2030. Together, these forces have transformed Dubai into not just a #magnet for #tourism, but also a hub for #talent, #innovation, and high-net-worth individuals. But what stood out most in our conversation was Sima’s perspective on Dubai’s evolving role as a #launchpad for #fashion retail, not only across the GCC but also into India, Southeast Asia, and Africa.

linkedin July 2025 Interview #35 - Claus-Dietrich Lahrs, Former CEO Hugo Boss &...

Why the #luxury industry must #prioritize #resilience and #desirability over high-risk expansion Claus-Dietrich and I first met around 15 years ago when he was leading the repositioning and internationalization of BOSS. Over the years, he has held senior leadership roles at iconic brands such as Cartier (part of Richemont), Christian Dior Couture (part of LVMH) and Bottega Veneta (part of Kering) giving him a rare, insider perspective on the inner workings of the world’s leading luxury groups. He is also one of the few Germans to have worked at such a high level in this global industry. Our conversation began with the meaning of luxury, the pivotal role Japan played in its global expansion, and how the industry broadened its appeal beyond its traditional clientele. We also explored how luxury lifestyles have become more refined and exclusive - and how sustainability and desirability will shape what’s next. It was a real pleasure to host Claus-Dietrich for lunch at our Wiesbaden office and to reflect together on both the hindsight and foresight shaping luxury today. This conversation is part of my interview series for my upcoming book on the future of fashion.

linkedin August 2025 Fast fashion no longer guarantees success

A few weeks ago, I had the privilege of sitting down with Michael Werner, Editor-at-Large at TextilWirtschaft to discuss the State of Fashion in Germany. We explored a wide range of topics: from weak #consumer #sentiment and the challenges facing #fast #fashion, to the current crisis in #luxury. Despite the headwinds, we also identified #bright #spots: growth pockets, resilient mid-market players, and real opportunities for those who are prepared to adapt. The full interview was originally published across 8 pages in TextilWirtschaft, the leading fashion industry magazine in the German-speaking world. We’ve now translated the piece to make it accessible to a wider audience.

linkedin Interview #36 - Alfons Kaiser, Editor-in-chief, FAZ Magazin

Why #Luxury Fulfills the Need for #Belonging and why We#Lack #True #Fashion #Creators Today These were the two central themes of my recent conversation with Dr. Alfons Kaiser, fashion critic at Frankfurter Allgemeine Zeitung Allgemeine Zeitung and editor-in-chief of FAZ Magazin. Together, we explored the evolving cultural role of fashion and luxury: - Fashion today is no longer just about style: it’s about visibility, social positioning, and emotional currency. - Young people increasingly define themselves through image and consumption rather than cultural capital. - Luxury brands have evolved from being mere retailers to becoming cultural powerhouses. - The future of luxury lies in shifting from objects to environments, from external display to internal meaning. We also reflected on the fading role of the fashion designer as a true creative force. The industry today favors marketing-driven collections and industrialized production cycles over bold ideas and strong creative voices. Visionaries are being replaced by managers. That shift may serve business efficiency - but it’s a loss for culture. Alfons is a strong voice in German fashion: a respected commentator, critic, and intellectual, and the well-known biographer of Karl Lagerfeld. What started as breakfast at our new offices turned into a three-hour exchange on fashion, culture - and business. This conversation is part of my ongoing series of interviews for my upcoming book on the Future of Fashion.

press March 2025 Luxury fashion betting on designer reshuffles faces tricky r...

Reuters by Mimosa Spencer, Elisa Anzolin & Tassilo HummelAchim shares his opinion on fashion’s current high musical chairs and their broader impact on the industry.

Luxury fashion houses are undergoing unprecedented designer reshuffles to boost brand appeal amid slowing sales and shopper fatigue. Achim notes that while brands often expect quick results from these creative leadership changes, the internal impact across departments - especially merchandising and marketing - takes time to become visible to consumers. He emphasizes that the ongoing wave of creative leadership changes signals a broader inflection point for the luxury industry. While proactive change is essential during periods of stagnation, brands must weigh short- and long-term consequences, which often exceed initial expectations in today’s volatile market.

linkedin Interview #38 - Carsten Keller, CEO, CHRONO 24

Carsten and I worked together for over a decade at McKinsey & Company where we joined forces to build the Apparel, Fashion & Luxury team. After leaving the Firm in 2016, he scaled Zalando’s partner program and connected retail business and in January 2024, he took the helm at Chrono24 Our conversation covered a lot of ground, e.g., 1) The growing importance of end-to-end marketplaces 2) Why many millennials view buying a luxury watch as a milestone 3) The booming resale market - and Chrono24’s pivotal role in it And yes, I couldn’t resist asking: Which watches actually sell? The answer: classic and timeless pieces consistently outperform trend-driven models. It was a pleasure (and a lot of fun) to sit down with Carsten and dive into the current state - and future - of luxury hard goods resale. This conversation is part of my ongoing interview series for my upcoming book on the Future of Fashion.

linkedin Interview #39 - Patrick Chalhoub, Executive Chairman, Chalho...

The Chalhoub Group is the largest luxury goods partner and retailer in the GCC, with a strong focus on fashion, beauty, and lifestyle. This family-owned group collaborates with iconic global brands such as Louis Vuitton, Christian Dior Couture, Lancôme, Carolina Herrera, and TORY BURCH, while also developing homegrown retail concepts tailored to the region. In our discussion, we explored how luxury has become deeply embedded in everyday life in the Middle East - how local tastes have evolved from status-driven prestige and logos to a more personal, expressive, and pleasure-oriented relationship with luxury. We also spoke about how the partnerships between global brands and local players have matured - moving beyond distribution into long-term, strategic collaboration. This conversation was another highlight in my journey to understand the transformation of fashion and luxury in the GCC - and to gather insights into where the industry is heading. It was recorded as part of my interview series for my upcoming book on the Future of Fashion.

press April 2025 Prada brings Versace home to create Italian luxury contender

Reuters by Elisa AnzolinAchim comments on Prada’s acquisition of Versace and its significance for Europe’s luxury landscape.

Prada’s deal to buy Versace signals a strategic push to build a true Italian powerhouse in global fashion. Achim considers this a pivotal step toward rebalancing Europe’s luxury landscape, long dominated by French conglomerates. Despite Italy’s strong “Made in Italy” image of trust and quality, the country has lacked a player of comparable scale. This move brings Versace, previously owned by US-listed Capri Holdings, back under Italian control, marking a shift from fragmented past efforts to a more consolidated national vision. Achim notes that unlike earlier small-scale ventures that failed to gain traction, this deal carries real strategic weight and long-term ambition.

press April 2025 Luxury industry at the crossroads of price increases once ag...

Vogue Business China by Junjie WangAchim shares his perspective on the impact of currency shifts and gold prices on luxury.

With the luxury market facing persistent headwinds and a prevailing sense of uncertainty, Achim notes that hopes for the US to offset weakening demand in China and Europe are quickly fading. Since the announcement of new tariffs, the US dollar has dropped nearly 10%, adding yet another hurdle for American consumers purchasing European luxury goods. Market sentiment, Achim emphasizes, is closely linked to consumer psychology - while many still have the financial means, they increasingly lack the confidence and willingness to spend. In this environment, gold has re-emerged as a global safe haven. Its surge is weighing on the luxury sector, not only diverting discretionary spending away from luxury, but also driving up costs for hard luxury items like jewelry and watches.

linkedin October 2025 Interview #23 - André Maeder, CEO Selfridges Group

Why the current #luxury #hangover is an opportunity to recalibrate. I had the pleasure of exchanging thoughts on the current slowdown of the luxury sector and the role of department stores in its recovery with my good friend André Maeder the CEO of Selfridges Group and a renowned retail industry leader and expert. He brings 50 years of professional experience, having held leadership roles at luxury retailers such as Harrods and THE KADEWE GROUP. We’ve known each other since his days in Metzingen with HUGO BOSS in 2008. Aspirational shoppers represent a substantial share of luxury sales, and their recent pullback has been a key driver of the industry’s slowdown. We discussed why brands cannot depend solely on the ultra-wealthy segment to navigate cyclical downturns, and how leveraging department stores as gateways and immersive spaces for both aspirational and affluent consumers might help the industry to overcome the challenges it is currently facing. Thank you, André, for your time - I truly enjoyed visiting you in London and having such an insightful conversation. Further highlights from my interview with André will be featured in my upcoming book on the Future of Fashion.

press April 2025 Luxury has experienced a cultural change

WirtschaftsWoche by Michelle Jura & Katharina KalinkeAchim comments on the democratization of luxury and the industry’s structural problems.

Following LVMH's weak quarterly results and falling share price, the downturn goes far beyond Trump's looming tariffs. They are just the latest piece in a much larger, already crumbling puzzle. Economic uncertainty continues to weigh on consumer confidence, but attributing the decline solely to external factors oversimplifies the luxury sector's deeper structural problems. Achim points out that internal missteps have also played a significant role. Years of aggressive price increases and efforts to make luxury more accessible to a broader audience have eroded the exclusivity that once defined luxury brands. He describes this as the democratization of luxury, a reflection of a broader cultural shift with a new understanding of luxury that is more experiential and value-driven than materialistic.

press April 2025 What Will Happen to the Handbags?

The New York Times by Vanessa Friedman & Jacob BernsteinAchim comments on how tariffs impact the luxury industry.

The US has long been seen as the next main growth engine for the luxury industry, but Trump's new tariffs have turned it into a source of concern. These measures act less as a tax on Europe and more as a burden on American consumers. Aside from Louis Vuitton's factory in Texas, no major brand is considering shifting production to the US, as "Made in Italy" and "Made in France" remain central to their identity. While some brands may be able to absorb the additional costs, years of price increases have already tested the limits of consumers. Although the luxury sector is more resilient than lower-margin segments, Achim warns that it won't remain untouched. The majority of luxury buyers are affluent or aspirational consumers - groups that are now hesitant amid market volatility and recession fears. In a climate of uncertainty, it is not necessarily wealth but confidence that drives indulgence, and right now, uncertainty is the prevailing mood, says Achim.

press May 2025 How luxury giant LVMH threatens to fall into Trump's customs...

WirtschaftsWoche by Katharina KalinkeAchim comments on the impact of tariffs and shifting dynamics in America’s role for luxury

Trump’s imposition of new tariffs is placing renewed pressure on European luxury houses. While no brand is seriously considering relocating production to the US, LVMH - already operating a manufacturing site in California - is the only one exploring an expansion of its American operations. The move aligns with Trump’s pro-domestic manufacturing narrative but remains largely symbolic, as Achim notes, given that a meaningful return of textile production to the US would require full automation - a challenge that has repeatedly proven unfeasible in the past. Beyond tariffs, Achim highlights the growing impact of luxury’s democratization, with middle-class consumers being the first to scale back spendings amid economic uncertainty. Even if tariffs prove temporary, he adds, they fail to restore the level of investment security needed. Mounting fears of a global recession and eroding investor confidence are steadily weakening America’s standing as a long-term growth engine for the industry.

press May 2025 Those who choose to wait gladly pay more

Die Zeit by Jennifer WuchnerAchim reflects on why Hermès continues to thrive amid a broader luxury downturn.

While most luxury brands are reporting sharp revenue declines, Hermès remains one of the few brands still growing, thanks to a model based on exclusivity and controlled scarcity. With highly limited production and years-long waiting lists, the brand's desirability continues to grow. Unlike other luxury houses that have begun to expand their product lines to reach a broader audience and raised prices too aggressively, Achim notes that this strategy of artificial scarcity is what sets Hermès apart. In his view, chasing volume through entry-level segments won't solve the crisis, as the real money is still made in handbags, where margins are highest.

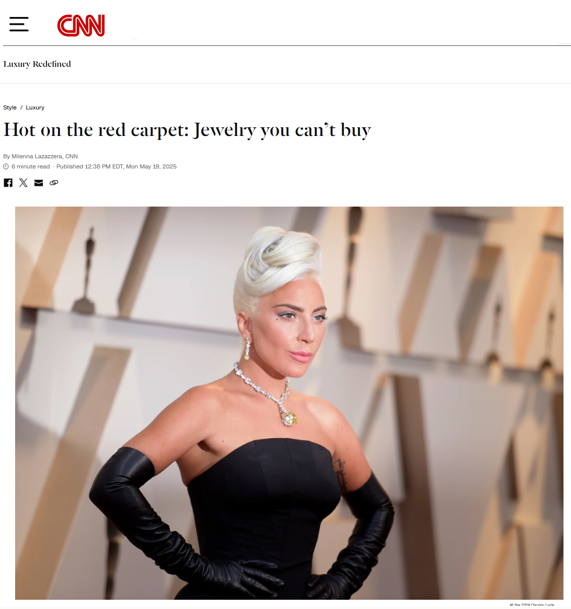

press May 2025 Hot on the red carpet: Jewelry you can’t buy

CNN by Milena LazazzeraAchim comments on how red carpet exposure of rare jewelry drives brand value

Many luxury brands started to display rare archival jewelry from private collections and museums by loaning these exclusive pieces to celebrities for red carpet events. This strategy transforms high-profile events into cultural treasure hunts, emphasizing the timelessness and heritage of these pieces. Achim notes that this strategy simultaneously boosts sales of the brand's jewelry that can be purchased by generating brand trust and higher visibility. By presenting their historical jewels as living legacies rather than static museum objects, brands generate excitement and deepen brand engagement. Achim sees this as a powerful way to reinforce the value and relevance of jewelry, positioning it as a lasting investment with enduring creative and cultural significance.

press May 2025 The rise and fall of Versace: Can Prada’s £1 billion buyout ...

Daily Mail You Magazine by John ArlidgeAchim shares his perspective on what is next for Versace after its acquisition by Prada Group.

With strong brand equity and a globally recognized identity, the foundations for Versace's new era are in place and Prada is a fitting new owner to build on. The Group brings cultural alignment, capital to invest, and strong product and marketing expertise. But structural change will be key, Achim notes. Versace's huge retail footprint doesn't match its current sales. He emphasizes the need to rethink its store strategy - possibly swapping some locations with Miu Miu - and anticipates leadership changes between Versace and Prada executives. These moves will set the stage for a broader creative and commercial reset. If executed well, Achim predicts significant sales growth in the coming years.

press May 2025 Hermès – The monobrand that beats big luxury conglomerates ...

CEO.Table Table Briefings by Kristian Kudela & Deniz Karaaslan,Achim explains Hermès’s continued success in a volatile market environment.

Hermès recently surpassed LVMH in terms of market capitalization, temporarily becoming the world's most valuable fashion company. This prompted many to take a closer look at its business model. Achim points out that Hermès has never reinvented itself - consistently building on quiet luxury desirability and strict distribution control. Many of its products have long waitlists, which further fuels this. Achim notes that this scarcity elevates brand perception and sustains product value over time. Consequently, Hermès bags often exceed their original retail price on the resale market, solidifying their status as timeless luxury investments.

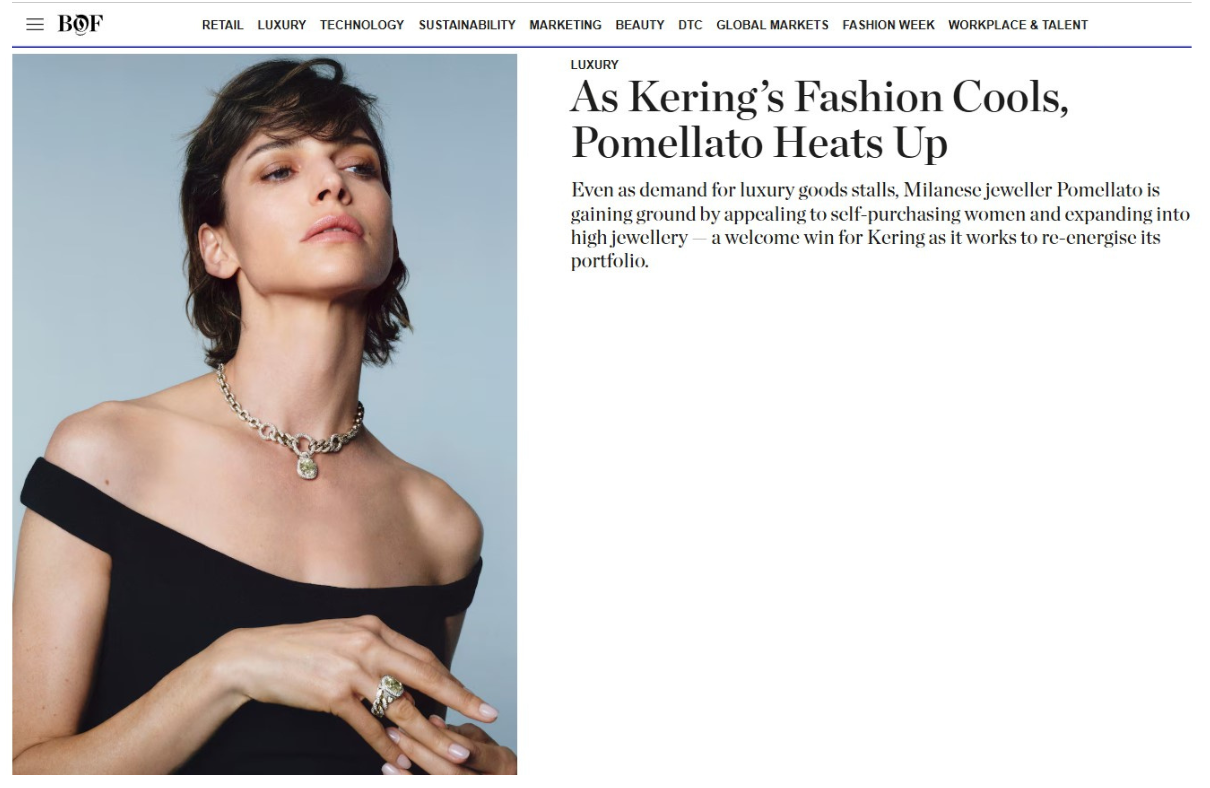

press June 2025 As Kering’s Fashion Cools, Pomellato Heats Up

BoF by Ming LiuAchim discusses how high-end jewellery is outperforming other luxury categories in times of economic uncertainty.

The Pomellato brand stands out as a positive performance outlier within parent company Kering, offering a blueprint for a shifting luxury landscape and overall industry phenomenon. While the demand for many luxury goods has softened, Achim notes that jewellery is gaining appeal due to its timeless nature and intrinsic value. Compared to other luxury items, it is viewed as a more solid, investment-worthy purchase. Achim also highlights that demand remains robust among high-net worth individuals, who are less affected by economic or geopolitical concerns. For brands, this makes high-end jewellery a strategic category to connect with a more resilient target segment.

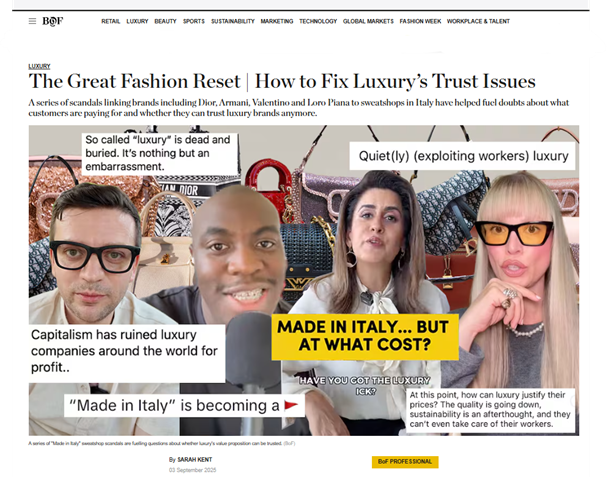

press September 2025 The Great Fashion Reset - How to Fix Luxury’s Trust Issues

BoF by Sarah KentAchim comments on recent scandals exposing luxury supply chains and its impact on luxury perception and consumer trust

The luxury industry is currently facing a structural crisis. Price hikes far beyond inflation have raised consumer doubts about value and trust. Slowing sales, management missteps and recent "Made in Italy" court cases exposing sweatshops, have further damaged the industry's image. Achim notes that luxury brands have been chasing volumes without strengthening supply chain controls, often turning a blind eye. He highlights that this is especially shocking for small-volume, high-margin companies, whose higher prices are justified by promises of exceptional quality.

press September 2025 Does Brunello Cucinelli Have the Answers to Luxury’s Problem...

BoF by Sarah KentAchim comments on how Brunello Cucinelli demonstrates resilience in a slowing luxury market.

Brunello Cucinelli is among the few luxury houses projecting double-digit growth in 2025, clearly outperforming both fellow high-end brands and the broader industry. Beyond consistently prioritizing sustainable growth over short-term profitability and targeting a narrow segment largely unaffected by the current economic downturn, Achim emphasizes that embodying restraint and enduring quality has become one of the brand’s key differentiators and success drivers.

press August 2025 Edelmode trifft Fruchtgummi

FOCUS MagazinAchim comments on Katjes’ acquisition of a majority stake in Munich-based fashion house Bogner.

German confectionery manufacturer Katjes has acquired a 60% stake in premium fashion brand Bogner, previously fully owned by its founding family. Achim views the deal as a positive signal amid today’s challenging fashion and luxury M&A landscape. He further highlights that a long-term strategy, adequate resources, and patience will be key to successfully repositioning and revitalizing the brand.

press July 2025 Houses link up to burnish jewelry growth at Kering

Financial Times by Milena LazazzeraAchim comments on the Gucci-Pomellato collaboration, viewing it as a smart way for Kering to navigate the current environment.

Kering brands Gucci and Pomellato have teamed up on a high jewelry collection to strengthen the luxury group’s jewelry segment, which has proven resilience even as its core fashion business faces pressure. With Gucci being in a transitional phase following the departure of Sabato De Sarno and ahead of Demna Gvasalia’s arrival as creative director, Achim states that the capsule serves as a strategic bridge to maintain momentum for the brand.

press September 2025 Fashion Briefing: Why are designers doing fall for spring?

Glossy by Jill ManoffAchim sheds light on why designers’ spring collections are leaning towards fall fashion.

During the recent Spring/Summer 2026 Fashion Weeks, it was notable that designers deviated from the designated season and showcased a variety of cold-weather items and materials. With many new creative directors making their debut, Achim notes that brands are trying to strike a balance between embracing newness and playing it safe in an uncertain macroeconomic climate, often favoring more conventional pieces. He adds that this more cautious approach best reflects current consumer sentiment, and that fall-inspired fashion feels more intuitive as many regions head into winter. Achim further shares his thoughts on the current luxury downturn and gives an outlook on how long the situation might persist.

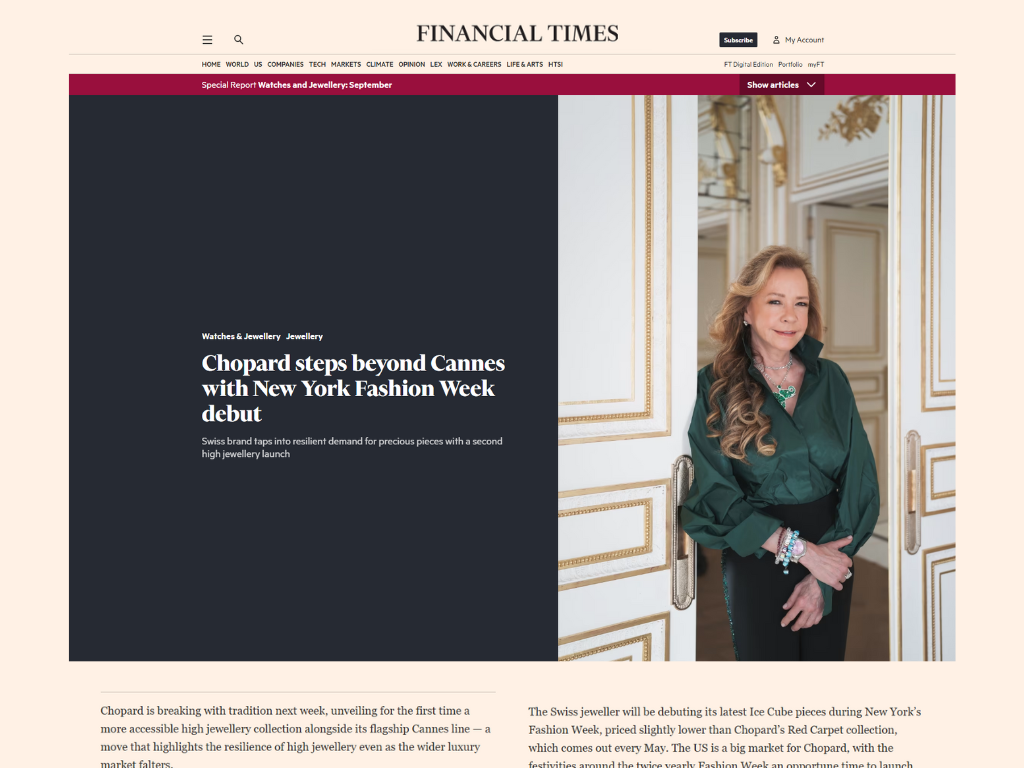

press September 2025 Chopard steps beyond Cannes with New York Fashion Week debut

Financial Times by Ming LiuAchim comments on Swiss jewelry brand Chopard's expansion into accessible high jewelry.

Chopard is moving to broaden its high jewelry offering with a more accessible collection, its second launch within a year. Achim notes this taps into resilient demand at a time when price inflation has pushed much of luxury higher, leaving jewelry looking relatively affordable and increasingly attractive.

He points out that only heritage players like Chopard can truly capitalize on this dynamic. For them, it’s a natural and low-risk extension of their identity. However, he cautions that demand is ultimately limited. Even ultra-wealthy clients have only so much capacity to spend, and once broader luxury spending returns, high jewelry will face tougher competition for their attention.

press September 2025 Luxury brands put to the test by Gen Z

Fashion Network by Sami MarshakAchim explains how luxury brands successfully attract Gen Z.

Gen Z consumers are set to account for an increasingly significant share of luxury sales, yet they are proving to be more difficult for brands to engage with than previous generations. While some heritage houses and newcomershave learned how to connect with this audience, others are struggling to keep pace. According to Achim, brands that resonate with Gen Z offer standout pieces that encapsulate their identity, enabling young consumers to buy into the brand without investing in a full look.

press May 2025 The future of Fashion

CEO World Magazine by Francesco PaganoAchim Berg reflects on fashion’s future and his mission to reshape it.

He shares his decision to found FashionSIGHTS, an independent think tank dedicated to rigorous research, strategic advisory across the fashion and luxury sectors. Berg praises Giorgio Armani for his timeless integrity and enduring influence while always having stayed true to its nature and seeing him as a benchmark for future generations of designers. He discusses that fashion must blend creativity with digital progress and deeper consumer engagement while preserving its craftsmanship roots. Looking ahead, Berg predicts 2025 will be a transition year, urging brands to reset, rethink, and rebuild amid U.S. market uncertainty.

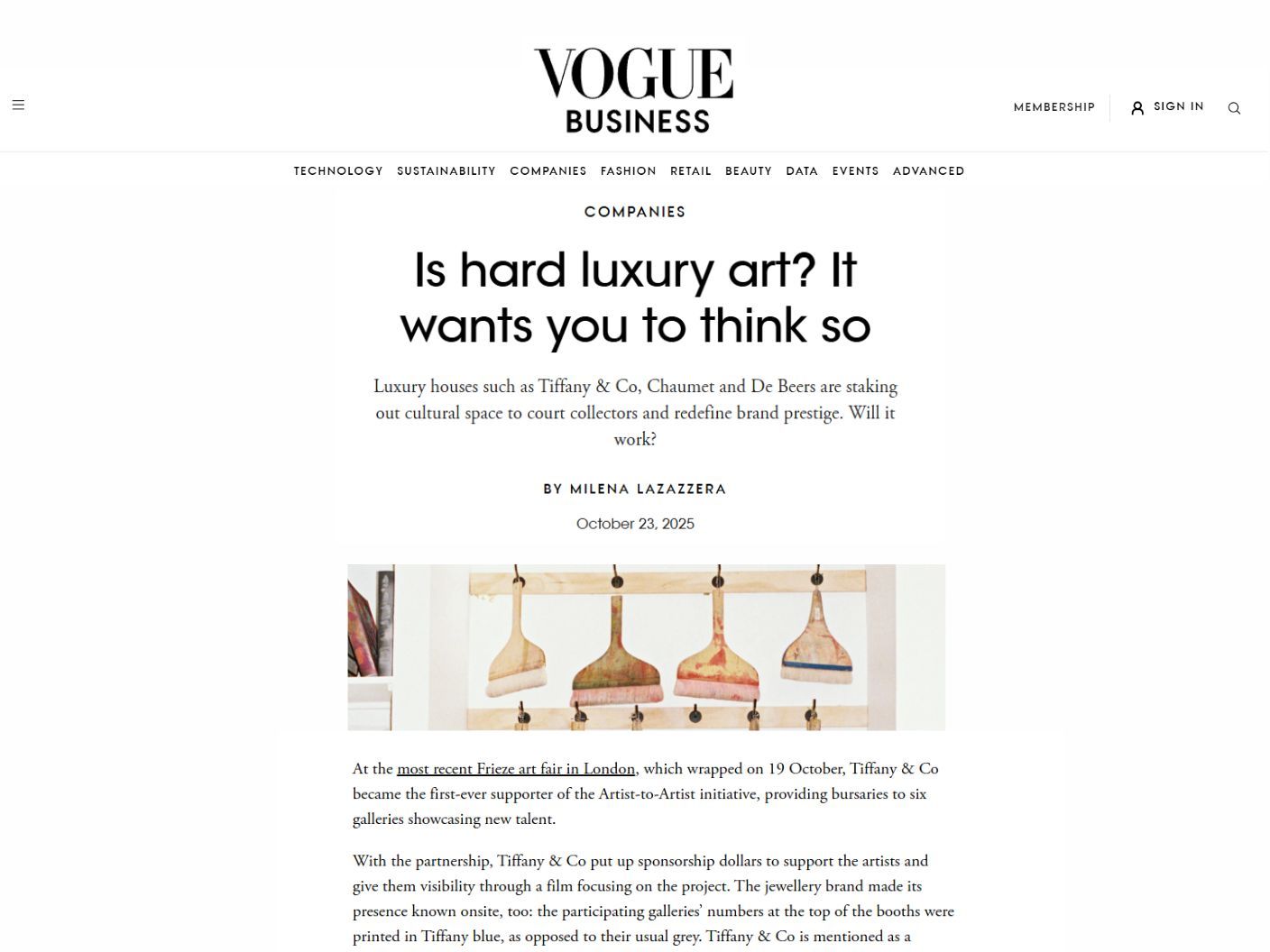

press October 2025 Is hard luxury art? It wants you to think so

Vogue Business by Milena LazazzeraAchim comments on the surge of luxury jewelry investing in and partnering with the art world, deepening the intersection between the two.

Luxury has long been associated with art through patronage and partnerships, yet hard luxury - particularly jewelry - has become further entwined with the art scene in recent years. What was once sporadic sponsorship has evolved into strategic collaboration, leveraging art’s ultimate advantage: its embodiment of craftsmanship and timeless value, the very essence of luxury itself. Achim notes that these initiatives are less about sales or measurable ROI and more about elevating cultural capital and brand prestige. He cautions, however, that as marketing budgets tighten, cultural sponsorships, which are often slow to yield tangible results, face growing scrutiny. Despite this dynamic, the movement continues accelerating as major jewelry brands strengthen their presence at global art fairs and cultural institutions.

press November 2025 The Twilight of the Luxury World

FAZ by Felix SchwarzAchim outlines the key drivers and mitigants shaping luxury’s current reckoning.

He outlines the factors behind luxury’s current downshift, that consumers have become increasingly oversaturated with physical goods. Luxury, once reserved for the super-rich, has democratized, with upper-middle-class aspirational buyers and emerging markets – particularly China – driving past growth. This expansion created dependencies, leaving the industry a victim of its own success as Chinese demand weakens. As brands seek to counter this slowdown, Achim highlights sport as a mitigant. Major sporting events provide global visibility and access to attention-scarce, affluent audiences, making them an increasingly important platform for luxury brands seeking global success.

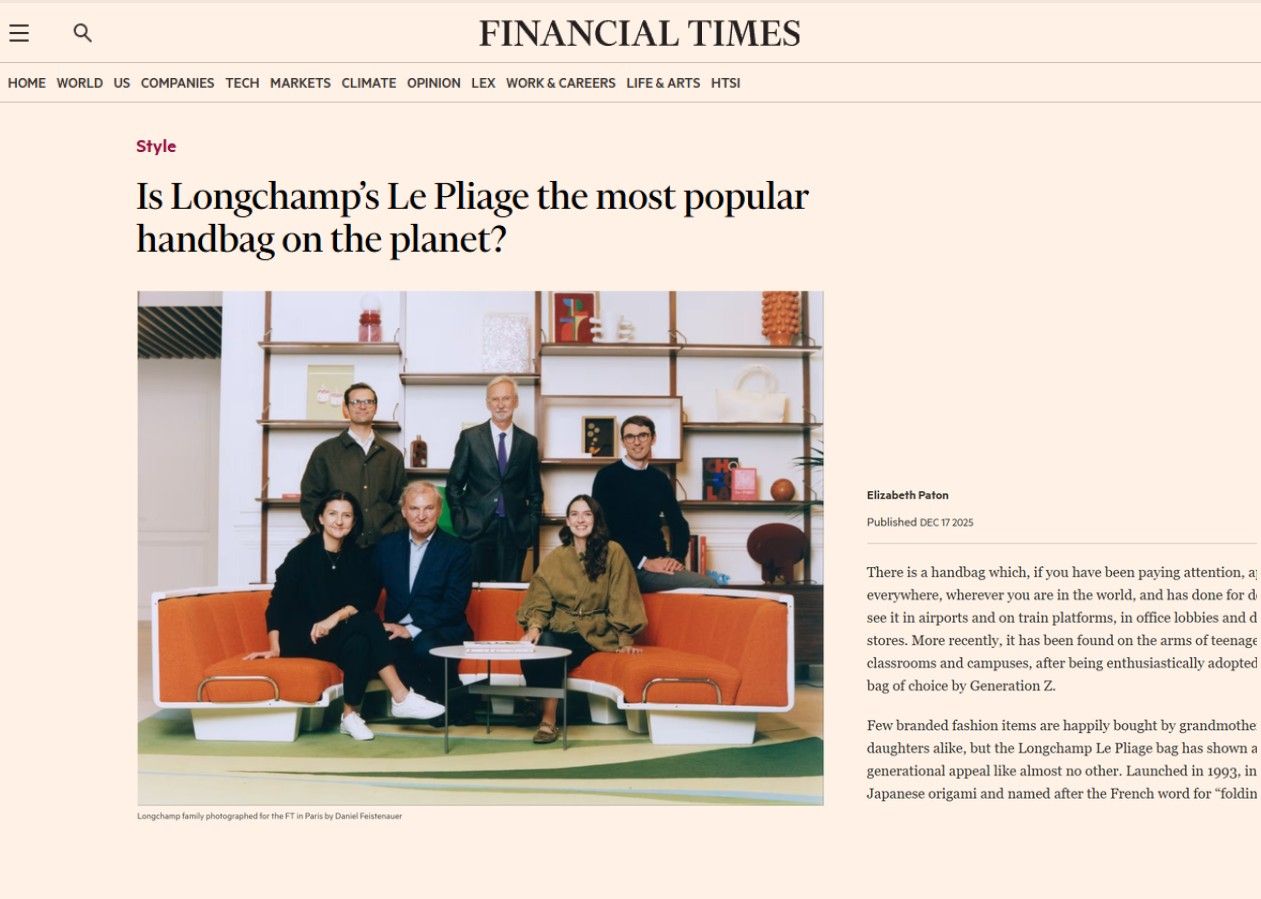

press December 2025 Is Longchamp’s Le Pliage the most popular handbag on the pla...

Financial Times by Elizabeth PatonAchim comments on Longchamp’s enduring popularity and the strategy behind it.

Longchamp has managed to transcend age groups, socio-economic segments, and seasons, remaining relevant for more than half a century. Achim highlights disciplined pricing as a key driver of this resilience. By maintaining accessible entry points while retaining appeal among affluent consumers, the brand has preserved broad-based demand. In contrast to the luxury sector’s aggressive price inflation, Longchamp’s gradual, cautious adjustments have limited its exposure to the consumer contraction affecting many peers. Strong media visibility, a clear focus on value for money, and the flexibility of a family-owned, medium-sized structure further reinforce the brand’s ability to prioritize product consistency over short-term margin expansion.

press December 2025 Brands of the Past – Who Will Buy Them in the Future?

Der Aktionär by Sarina RosenbuschAchim comments on luxury’s current reckoning amid macro pressures, weak consumer appetite, and what it will take to recover.

He highlights the industry paying the price for years of vanity-driven growth, where overexpansion and price inflation failed to deliver sustainable returns. Luxury is now entering a necessary phase of consolidation, seen as a prerequisite for the next growth cycle. While the ongoing reshuffling of creative directors aims to refresh creativity, Achim cautions that its impact will take time to materialize. He notes that luxury fulfills a fundamental human need for aspiration and self-expression, making recovery, though gradual, inevitable. A rebound will depend on broader economic stabilization, renewed growth in China, and easing regulatory pressure in the U.S. He adds that current experience-led luxury strategies enhance brand image rather than drive effective revenue growth.