Explore our library, where insights, press articles, and events are organized by tags, making it easy to find relevant topics.

press December 2024 Getting dressed will be fun again

Financial Times by Kati ChitrakornAchim shares his perspective on the key themes shaping the fashion industry in 2025.

After a drop in global sales of personal luxury goods in 2024, the industry is hopeful for modest recovery in 2025. Achim highlights the need to correct overinflated pricing and notes that structural changes, including the offloading of underperforming assets, may be necessary. Ethical and social responsibility will remain critical and growth opportunities will be mostly seen in emerging markets. Major deals in the fashion industry are unlikely in the near term due to stagnant IPO markets. Nevertheless, Achim predicts further consolidation across the industry in the months ahead as well as a shift back to a more personal, individualistic style.

press December 2024 Will luxury stocks remain slow sellers?

Der Aktionär Edition 2025 by Sarina RosenbuschIn an interview with Der Aktionär, Achim provides his perspective on the outlook for the fashion and luxury market in 2025. Next year will remain challenging for luxury brands, marked by ongoing market consolidation. While the luxury categories of fashion, jewelry, and watches face significant headwinds, demand for experiences and travel continues to thrive. Additionally, more space has emerged between the mid-market and luxury segments, allowing premium brandslike Coach to flourish. Fast fashion players such as H&M and Zara are elevating their positioning to differentiate themselves from Asian competitor Shein, while appealing to customers who increasingly prioritize value for money and sustainability. Meanwhile, the booming sportswear segment is undergoing dynamic shifts, with challenger brands (e.g., On, Lululemon, Skechers) steadily gaining market share from the incumbents Nike, Adidas, or Puma.

press December 2024 Fashion industry faces cautious consumers during Christmas s...

tagesschau24 Update Wirtschaft by Anne-Catherine BeckAchim discusses on German television how this year’s Christmas business is unfolding for the fashion and luxury industry.

He points out that while city centers may seem less busy, people are still shopping, especially now during the holiday season – but there is a noticeable reluctance to spend. Affordable luxury in particular is struggling as aspirational consumers cut back, while high net worth individuals continue to spend at the top end of the segment. There are fewer tourists from SoutheastAsia as they shift their spending to Japan given favorable exchange rates; although Americans and Middle Eastern customers are increasingly present inEurope. In addition, online and secondhand sales are growing and taking sharefrom brick-and-mortar stores. Achim attributes the industry’s challenges to a stagnant market in Europe, economic uncertainty, and an increasinglycompetitive landscape. This has led to a wave of consolidation, as evidenced by the recent acquisitions such as the Zalando-About You or MyTheresa-Net-a-Porterdeals.linkedin How to Spend It...

has been one of my favorite weekend rituals for over 20 years. There’s something special about getting up early on a Saturday, when thelinkedin February 2025 Is luxury elder care the next frontier?

Is #luxury #elder #care the next frontier? This weekend, I came across an intriguing Financial Times article about the rise of high-end care homes in the…

press October 2024 Luxury online retail – Mytheresa is now facing these challen...

WirtschaftsWoche by Nele Antonia HöflerIn an article in WirtschaftsWoche, Achim comments on the challenges that online luxury retailers like MyTheresa are currently facing and how they can overcome them.

MyTheresa has announced plans to acquire rival Yoox Net-a-Porter in a bid to become the leader in online luxury e-tailing. However, the company faces several challenges as demand for luxury goods has weakened due to uncertain consumer sentiment and rising prices of luxury goods. In addition, luxury brands are increasingly turning to direct sales and moving away from multi-brandplatforms. Growth alone is no longer sufficient for luxury online players; instead investors are now demanding profitability. MyTheresa plans to overcome these hurdles through synergies, a curated offering and the integration of YNAP's platform and customer data.

press October 2024 What's next for luxury e-commerce

glossy.com by Jill ManoffAchim discusses his perspective on the future of luxury e-commerce with Glossy's Jill Manoff.

Luxury brands are increasingly by passing multi-brand e-tailers, offering direct-to-consumer sales with full product ranges, exclusive perks, and enhanced omnichannel experiences. Many once highly valued e-commerce platform shave struggled to achieve profitable growth in a high-interest rate environment, while others, such as Mytheresa, have thrived by focusing their differentiation strategy on curation rather than low prices, and by building customer loyalty through exclusive services and events. Although luxurye-commerce is projected to grow by 20 to 30 percent, physical retail will remain essential for luxury brands.

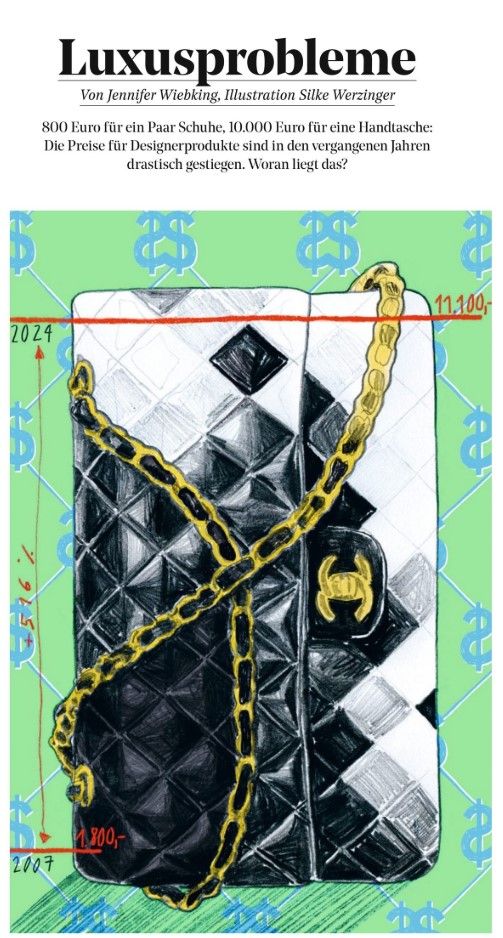

press September 2024 LuxuryProblems

FAZ Magazin by Jennifer WiebkingAchim talks with Jennifer Wiebking from the FAZ about the luxury goods boom, the COVID effect, and why the industry is now suffering a post pandemic hangover.

Luxury fashion prices have risen dramatically, with Chanel's iconic 11.12 bag increasing by 470% since 2007, reflecting broader hyperinflation across the industry. As a result of the massive price increases, more accessible luxury brands such as Longchamp and new entrants such as Polène are gaining popularity, offering high quality products at relatively lower prices amidst rising consumer price sensitivity.

press September 2024 From hawk to dove: the Fed's rate cut and its impact on fash...

Modaes.com by Pilar RiañoIn a discussion with Modaes journalists, Achim shares his perspective on the impact of interest rates on the fashion industry.

The FED’s recent interest rate cut, the first in over four years, has sparked mixed reactions in the fashion industry. Some experts believe it could stimulate consumer spending, especially during the holiday season, while others think its effects may take time to materialize, and the upcoming U.S. elections could heavily influence its impact. The rate cut is expected to weaken the dollar, potentially reducing costs for European fashion companies sourcing materials from abroad but making exports to the U.S. more expensive.

press August 2024 Scandinavian MIND Transformation conference Copenhagen 2024

scandinavianmind.comA fireside chat with Achim and Konrad Olsson at the Scandinavian MIND Transformation conference in Copenhagen.

Achim Berg reflects on the current state of the fashion industry, including the post-COVID boom and the industry's hard landing in the face of multiple global crises, a challenging macro economic environment, and weakening consumer demand. He also reflects on his personal career, the lessons learned at McKinsey, and provides insight into the plans for his new company.

press February 2025 Spanish fashion conglomerate conquers Leipzig

Leipziger Volkszeitung by Florian ReinkeAchim shares his perspective on Inditex’s expansion strategy in Leipzig, Germany.

Inditex is expanding its brand portfolio in Leipzig with new stores for Zara, Pull & Bear, Bershka, and Stradivarius. Achim points out that this move reflects broader industry shifts, particularly in the mid-market segment, where competition has weakened due to bankruptcies. Coupled with lower retail rents, Inditex is seizing the opportunity for growth. Achim further explains that Inditex’s vertically integrated business model is a key driver of this success, allowing the company to control the entire value chain and operate with greater resilience.

press February 2025 Major luxury groups show weaknesses - with exceptions

WirtschaftsWoche by Emma MöllenbrockAchim discusses the broader challenges of struggling luxury houses and success factors that set certain brands apart from its competitors.

The luxury sector is facing challenges as consumer demand weakens and growth driven by price increases reached its limits. Achim highlights two successful categories: zeitgeist brands that thrive on trends, and exclusive high-end brands like Hermes, benefiting from wealthy buyers whose spending remains stable during economic downturns. In contrast, luxury brands focusing on volume rather than exclusivity, such as Gucci and LVMH, are more vulnerable to economic fluctuations. Achim emphasizes that profitability and an adapted pricing strategy will be key to sustaining growth in the future.

press April 2025 Luxury industry at the crossroads of price increases once ag...

Vogue Business China by Junjie WangAchim shares his perspective on the impact of currency shifts and gold prices on luxury.

With the luxury market facing persistent headwinds and a prevailing sense of uncertainty, Achim notes that hopes for the US to offset weakening demand in China and Europe are quickly fading. Since the announcement of new tariffs, the US dollar has dropped nearly 10%, adding yet another hurdle for American consumers purchasing European luxury goods. Market sentiment, Achim emphasizes, is closely linked to consumer psychology - while many still have the financial means, they increasingly lack the confidence and willingness to spend. In this environment, gold has re-emerged as a global safe haven. Its surge is weighing on the luxury sector, not only diverting discretionary spending away from luxury, but also driving up costs for hard luxury items like jewelry and watches.

press April 2025 What Will Happen to the Handbags?

The New York Times by Vanessa Friedman & Jacob BernsteinAchim comments on how tariffs impact the luxury industry.

The US has long been seen as the next main growth engine for the luxury industry, but Trump's new tariffs have turned it into a source of concern. These measures act less as a tax on Europe and more as a burden on American consumers. Aside from Louis Vuitton's factory in Texas, no major brand is considering shifting production to the US, as "Made in Italy" and "Made in France" remain central to their identity. While some brands may be able to absorb the additional costs, years of price increases have already tested the limits of consumers. Although the luxury sector is more resilient than lower-margin segments, Achim warns that it won't remain untouched. The majority of luxury buyers are affluent or aspirational consumers - groups that are now hesitant amid market volatility and recession fears. In a climate of uncertainty, it is not necessarily wealth but confidence that drives indulgence, and right now, uncertainty is the prevailing mood, says Achim.

press May 2025 Those who choose to wait gladly pay more

Die Zeit by Jennifer WuchnerAchim reflects on why Hermès continues to thrive amid a broader luxury downturn.

While most luxury brands are reporting sharp revenue declines, Hermès remains one of the few brands still growing, thanks to a model based on exclusivity and controlled scarcity. With highly limited production and years-long waiting lists, the brand's desirability continues to grow. Unlike other luxury houses that have begun to expand their product lines to reach a broader audience and raised prices too aggressively, Achim notes that this strategy of artificial scarcity is what sets Hermès apart. In his view, chasing volume through entry-level segments won't solve the crisis, as the real money is still made in handbags, where margins are highest.

press May 2025 Hermès – The monobrand that beats big luxury conglomerates ...

CEO.Table Table Briefings by Kristian Kudela & Deniz Karaaslan,Achim explains Hermès’s continued success in a volatile market environment.

Hermès recently surpassed LVMH in terms of market capitalization, temporarily becoming the world's most valuable fashion company. This prompted many to take a closer look at its business model. Achim points out that Hermès has never reinvented itself - consistently building on quiet luxury desirability and strict distribution control. Many of its products have long waitlists, which further fuels this. Achim notes that this scarcity elevates brand perception and sustains product value over time. Consequently, Hermès bags often exceed their original retail price on the resale market, solidifying their status as timeless luxury investments.

press June 2025 As Kering’s Fashion Cools, Pomellato Heats Up

BoF by Ming LiuAchim discusses how high-end jewellery is outperforming other luxury categories in times of economic uncertainty.

The Pomellato brand stands out as a positive performance outlier within parent company Kering, offering a blueprint for a shifting luxury landscape and overall industry phenomenon. While the demand for many luxury goods has softened, Achim notes that jewellery is gaining appeal due to its timeless nature and intrinsic value. Compared to other luxury items, it is viewed as a more solid, investment-worthy purchase. Achim also highlights that demand remains robust among high-net worth individuals, who are less affected by economic or geopolitical concerns. For brands, this makes high-end jewellery a strategic category to connect with a more resilient target segment.

press August 2025 These NJ and PA designers are making modest workout gear tha...

northjersey.com by Deena YellinAchim shares his perspective on the state of modest fashion, highlighting its growth drivers, increasing popularity, and strong outlook.

Modest fashion, particularly activewear that conceals without constricting, is gaining traction. Achim notes that the global Muslim community, projected to comprise nearly a third of the world’s population by 2050, already accounts for a significant share of fashion and luxury sales, with its spending set to continue rising in the coming years. Achim further emphasizes that this demographic’s upcoming affluence and purchasing power represent a structural growth opportunity for brands, rather than a passing trend.

press July 2025 Which Sneaker Has What It Takes to Be the Next Hype?

FAZ by Sebastian BalzterAchim discusses today’s sneaker movements, highlighting the role of luxury brands versus sports brands and the differing preferences across target groups.

Comparing major sports labels such as Nike, Adidas, and Puma, the article examines which models could spark the next global hype. Achim notes that brands rely on external sources and AI-driven analyses of consumer behavior to inform strategic decisions. Luxury labels are poised to create the next "it shoe," while sports brands focus on affordable, trendy lifestyle models. Success ultimately depends on the target audience: younger consumers chase new releases, while many in their 40s prefer traditional styles.

press September 2025 Are US fashion brands at risk of growing anti-American backl...

The Guardian by Lauren CochraneAchim comments on concerns that U.S. tariff policies may fuel anti-American sentiment abroad.

Sparked by Levi’s warning of potential sales losses in the UK, the debate centers on whether fashion brands face such risks. Achim notes that the backlash usually targets companies tied to the U.S. government, not fashion labels. He also points out that consumers continue to embrace American products, such as Apple and Netflix without hesitation. Debates around wokeness and sustainability have shown that consumers are usually less consistent and radical than media narratives suggest, often continuing to favor brands regardless of their reputation in those areas.

press July 2025 Uniqlo Lands in Munich: The Battle of the Fashion Giants

Münchner Merkur/tz by Dominik GöttlerAchim comments on Uniqlo’s continued push into the German market with its planned Munich store opening in fall 2025.

The company's expansion into Munich highlights both the opportunities and the hurdles of competing in Germany’s saturated fast-fashion landscape. Achim notes that the brand’s focus on durable, high-quality basics aligns with the shift in consumer preferences away from disposable fashion and toward functional, value-driven basics. Its Japanese image of precision and thoroughness further strengthens its positioning, even though production practices are similar to those of its rivals. He adds that durability supports Uniqlo’s sustainability profile; however, recycling challenges demonstrate that the industry is still in its infancy. Achim further states that Germany is a challenging market due to full wardrobes, cautious spending, and strong low-price competition. Achim makes clear that Uniqlo’s future in Germany depends on its ability to seize market share from established players.

press September 2025 Fashion Briefing: Why are designers doing fall for spring?

Glossy by Jill ManoffAchim sheds light on why designers’ spring collections are leaning towards fall fashion.

During the recent Spring/Summer 2026 Fashion Weeks, it was notable that designers deviated from the designated season and showcased a variety of cold-weather items and materials. With many new creative directors making their debut, Achim notes that brands are trying to strike a balance between embracing newness and playing it safe in an uncertain macroeconomic climate, often favoring more conventional pieces. He adds that this more cautious approach best reflects current consumer sentiment, and that fall-inspired fashion feels more intuitive as many regions head into winter. Achim further shares his thoughts on the current luxury downturn and gives an outlook on how long the situation might persist.

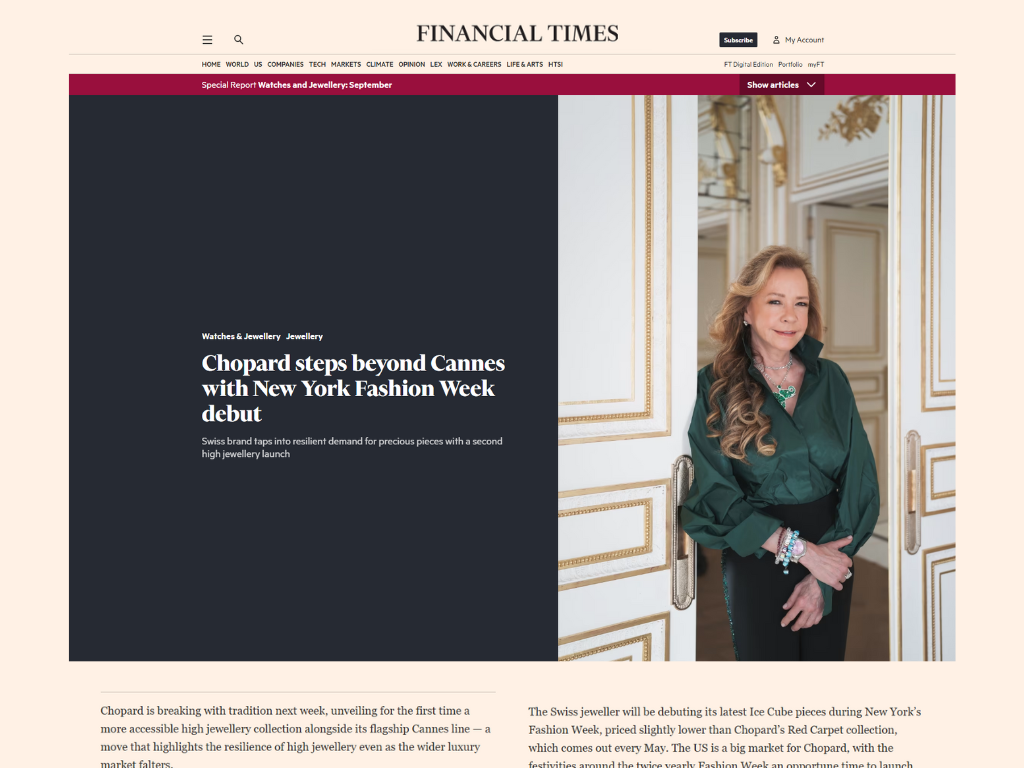

press September 2025 Chopard steps beyond Cannes with New York Fashion Week debut

Financial Times by Ming LiuAchim comments on Swiss jewelry brand Chopard's expansion into accessible high jewelry.

Chopard is moving to broaden its high jewelry offering with a more accessible collection, its second launch within a year. Achim notes this taps into resilient demand at a time when price inflation has pushed much of luxury higher, leaving jewelry looking relatively affordable and increasingly attractive.

He points out that only heritage players like Chopard can truly capitalize on this dynamic. For them, it’s a natural and low-risk extension of their identity. However, he cautions that demand is ultimately limited. Even ultra-wealthy clients have only so much capacity to spend, and once broader luxury spending returns, high jewelry will face tougher competition for their attention.

press September 2025 Luxury brands put to the test by Gen Z

Fashion Network by Sami MarshakAchim explains how luxury brands successfully attract Gen Z.

Gen Z consumers are set to account for an increasingly significant share of luxury sales, yet they are proving to be more difficult for brands to engage with than previous generations. While some heritage houses and newcomershave learned how to connect with this audience, others are struggling to keep pace. According to Achim, brands that resonate with Gen Z offer standout pieces that encapsulate their identity, enabling young consumers to buy into the brand without investing in a full look.

press October 2025 Fashion Forward: What Will the Industry Envision in 2026?

Modaes by Celia Oliveras, Pilar RianoAchim comments on what factors will shape the fashion industry in the year ahead.

As 2026 approaches, the fashion industry is bracing itself for another year of uncertainty. In a recent interview with Modaes, Achim shared his perspective on the structural forces shaping this reality. He notes that geopolitics, tariffs, and shifting regulations are driving market changes, leading companies to move away from centralized management towards distributed decision-making. He further points out that adapting to these circumstances comes at a high price, requiring businesses to carefully balance speed, costs and risk when making investment choices. Achim also highlights that, amid growing insecurity surrounding the impact of AI and the macroeconomic environment on the job market, consumers favor savings and smaller purchases over heavy expenditures.

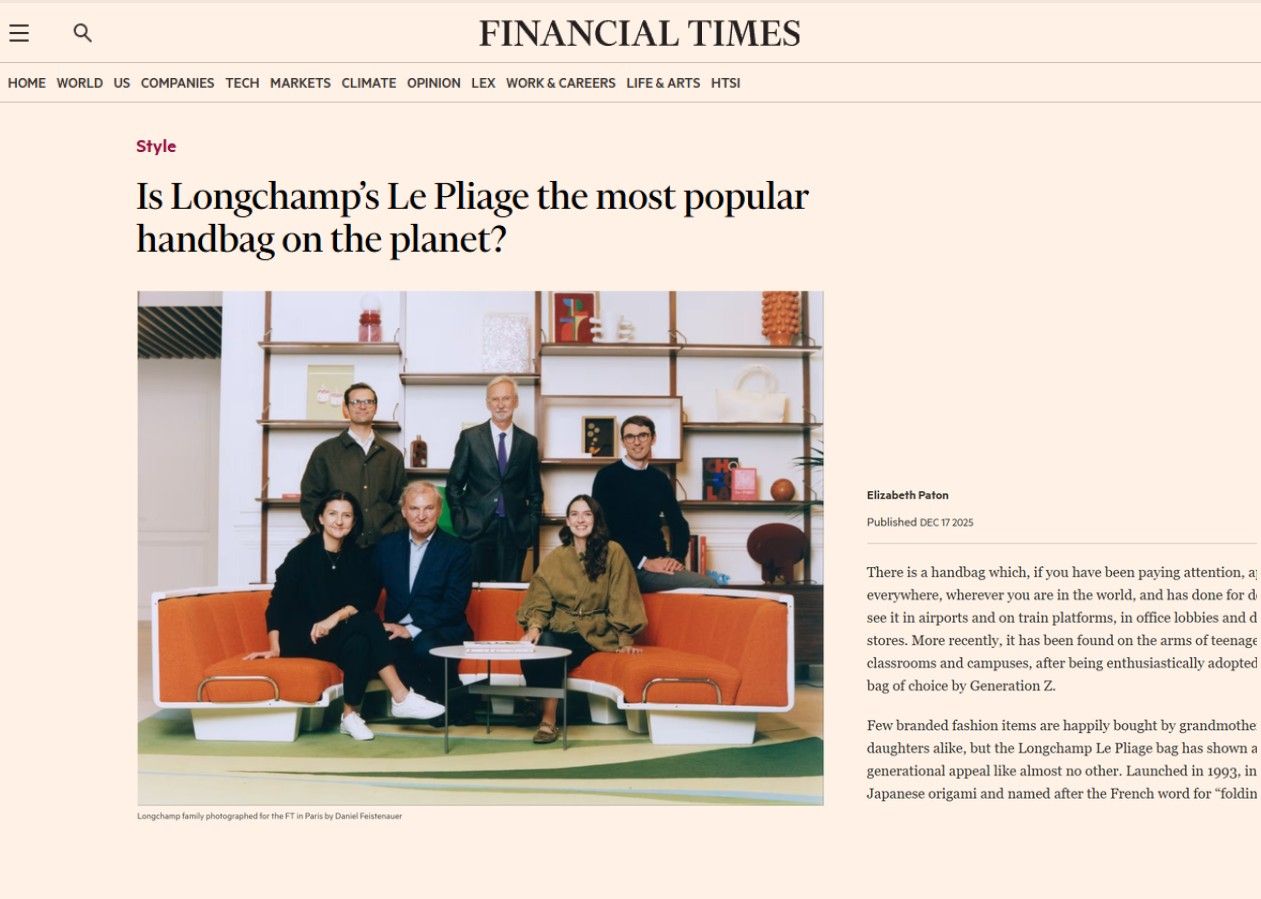

press December 2025 Is Longchamp’s Le Pliage the most popular handbag on the pla...

Financial Times by Elizabeth PatonAchim comments on Longchamp’s enduring popularity and the strategy behind it.

Longchamp has managed to transcend age groups, socio-economic segments, and seasons, remaining relevant for more than half a century. Achim highlights disciplined pricing as a key driver of this resilience. By maintaining accessible entry points while retaining appeal among affluent consumers, the brand has preserved broad-based demand. In contrast to the luxury sector’s aggressive price inflation, Longchamp’s gradual, cautious adjustments have limited its exposure to the consumer contraction affecting many peers. Strong media visibility, a clear focus on value for money, and the flexibility of a family-owned, medium-sized structure further reinforce the brand’s ability to prioritize product consistency over short-term margin expansion.